Virginia Organizing at the CFPB Hearings

On April 7, 2016, Virginia Organizing leaders traveled to Washington, D.C. for the Senate Banking Committee hearing on the Consumer Financial Protection Bureau (CFPB). Virginia Or ...

Read More »Virginia Organizing Calls on Senators Warner and Kaine to Support a Strong Consumer Financial Protection Bureau

Fredericksburg, Va.— Virginia Organizing leaders will visit Washington, D.C. on Thursday, April 7 to attend the Senate Banking Committee hearing where Consumer Financial Protectio ...

Read More »Support Consumers, NOT Predatory Lenders

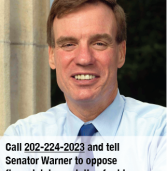

A bipartisan group of U.S. Senators will soon introduce legislation that will seriously put at risk current, vital regulations that protect everything from workers health, climate ...

Read More »Simple Things Can Help Virginia Families Build Cushion

Originally published by Public News Service. Working families in Virginia are having a hard time building up even a small financial cushion. But the authors of a new policy brief ...

Read More »Families Can’t Wait

Click here to see how much wealth is stripped from our communities by payday and car title loans since March 2015. Every day, payday and car title lenders drain $23,951,459 out of ...

Read More »Debra Grant: Payday lenders prey on women, families

Published by the Virginian-Pilot I had a relative who needed to borrow $150, so I took out a payday loan to help. Every month, I would have to roll the loan over until the next mo ...

Read More »Inside The Fast-Cash World Of Virginia Car-Title Lenders

Listen to the full story at WAMU (click here). You may have heard their jingles on the radio or seen their commercials that play endlessly on late-night TV. Perhaps you have driv ...

Read More »Virginia consumers benefit from CFPB

Published in Public News Service. RICHMOND, Va. – The Consumer Financial Protection Bureau (CFPB), which celebrates its fourth anniversary this month, has recovered billions of do ...

Read More »Jay Johnson Talks National Movements at Populism 2015

Virginia Organizing Treasurer Jay Johnson rallied the crowd at Populism 2015 in Washington, D.C. Jay's remarks were part of a Saturday plenary session featuring speakers across th ...

Read More »Consumer Financial Protection Bureau (CFPB) Working to End Payday Loan Debt Traps

The Consumer Financial Protection Bureau (CFPB) is holding a field hearing in Richmond today and will announce that it is publishing an outline of proposals under consideration th ...

Read More »